College athletes eat on the run

The transition from high school to college is an adjustment for any student but probably more so for a student with learning differences. Students who were used to getting their needs met by ieps suddenly find themselves iep-less in college, as that document plays no part in postsecondary education. Those who relied on parents, not just to advocate for them, but to wake them in the morning, remind them of due dates, and proofread their papers, suddenly realize they are on their own. The consequences of procrastination and disorganization that parents staved off can now happen.

for middle school and high school students, cheap homework writing service help sites are often maintained by the school district and by teachers. If this resource is available to you then take full advantage of it. There are also general sites that are available as well. Google ‘homework help’ and you’ll be exposed to any number of sites that are ready to help you solve a problem.

for starters, get involved! There are plenty of school activities you can do. Most colleges have fraternities and other social groups that are the core of on campus life. Just look at the campus calendar or newspaper and you’re bound to find a ton of things covering a number of interests. Go to a concert. Attend a sporting event. Just don’t sit around in your https://doahomework.com/college-homework/

Early childhood education research paper topics

Dorm room. though now is an increasing stressful and busy world, it does not imply the parents should sacrifice the amount of time that they are giving to their kids especially those that are in school. If workload and active routine don’t permit them to furnish homework help for the kid who’s in college homework help, there are some different ways that this can be carried out.

unfortunately, max suffered help with college homework self-doubts all through school. He lived with the “knowledge” that he was a math dummy. His doubts about his intelligence seeped into other aspects of his life. He didn’t always trust his own judgment. He relied more on the opinions of others than he did on his own beliefs and desires. If max had received more guidance in developing a self-empowering perspective earlier in life, he would have had more faith in his ability to succeed and would have more academic successes to look back on.

at 40 years of age, you prove wise. You will find that you contain patience and more of an eagerness to learn. You will find that you will be more zealous in completing homework as well as asking for help from the instructors

How to write female characters

If needed. college students need to be taught coping strategies for the pressure and stress in their lives. They need to be aware of the dangers of using alcohol to cope. It is very important to talk with your college student or your teen. Make sure they are dealing with college alright. If they are having problems reassure them they can turn to you and you can figure out a solution together instead of resorting

To alcohol.

College athletes eat on the run

The transition from high school to college is an adjustment for any student but probably more so for a student with learning differences. Students who were used to getting their needs met by ieps suddenly find themselves iep-less in college, as that document plays no part in postsecondary education. Those who relied on parents, not just to advocate for them, but to wake them in the morning, remind them of due dates, and proofread their papers, suddenly realize they are on their own. The consequences of procrastination and disorganization that parents staved off can now happen.

for middle school and high school students, cheap homework writing service help sites are often maintained by the school district and by teachers. If this resource is available to you then take full advantage of it. There are also general sites that are available as well. Google ‘homework help’ and you’ll be exposed to any number of sites that are ready to help you solve a problem.

for starters, get involved! There are plenty of school activities you can do. Most colleges have fraternities and other social groups that are the core of on campus life. Just look at the campus calendar or newspaper and you’re bound to find a ton of things covering a number of interests. Go to a concert. Attend a sporting event. Just don’t sit around in your

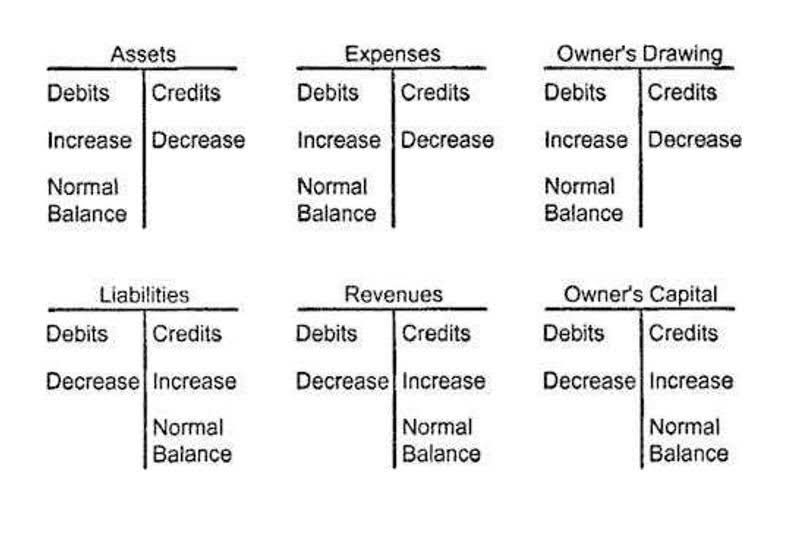

How to write off bad debt in quickbooks online

Dorm room. though now is an increasing stressful and busy world, it does not imply the parents should sacrifice the amount of time that they are giving to their kids especially those that are in school. If workload and active routine don’t permit them to furnish homework help for the kid who’s in college homework help, there are some different ways that this can be carried out.

unfortunately, max suffered help with college homework self-doubts all through school. He lived with the “knowledge” that he was a math dummy. His doubts about his intelligence seeped into other aspects of his life. He didn’t always trust his own judgment. He relied more on the opinions of others than he did on his own beliefs and desires. If max had received more guidance in developing a self-empowering perspective earlier in life, he would have had more faith in his ability to succeed and would have more academic successes to look back on.

at 40 years of age, you prove wise. You will find that you contain patience and more of an eagerness to learn. You will find that you will be more zealous in completing homework as well as asking for help from the instructors

How to write chemical formulas in word

If needed. college students need to be taught coping strategies for the pressure and stress in their lives. They need to be aware of the dangers of using alcohol to cope. It is very important to talk with your college student or your teen. Make sure they are dealing with college alright. If they are having problems reassure them they can turn to you and you can figure out a solution together instead of resorting